Features and Benefits

Low Foreign Currency Conversion Fee

Low foreign currency conversion fee of 2% for more savings on international purchases.

Enjoy Rewards and Savings Here, in Japan, and Everywhere You Go

- Earn one (1) Rewards Point for every Php100 qualified spend. Accumulate your points and redeem for airline miles, cash rebate, or annual membership fee waiver.

Learn more - Year-round special promotions and discounts from shopping, dining, travel, and leisure partner merchants.

Learn more on the latest EastWest Special Perks and Privileges.

Learn more on the latest JCB exclusive offers and promotions in the Philippines, Japan and other global destinations. - Low foreign currency conversion fee of 2% for more savings on international purchases.

Elevate your travel experience

- Complimentary comprehensive travel accident and inconvenience insurance.

Learn more - Complimentary access1 of up to six (6) times during the annual service2 period to world-class amenities at the JCB Airport Lounge in Japan and Hawaii for you and your supplementary cardholder.

Check the details of the JCB Airport Lounge services before your visit.

Learn more - Free and exclusive entry to JCB Plaza Lounges located in major shopping areas.

Learn more - Travel information and guide to exclusive offers and services with free access to the JCB Japan Guide app. Plus, get special rates on JCB Global Wi-Fi router rental.

Learn more on JCB Japan Guide app.

Learn more on JCB Global Wi-Fi router rental.

1 Cardholder will be charged the regular guest fee determined by each lounge on every visit for accompanying guests or exceeding the six (6) complimentary access on every visit.

2 Annual service period is from April of the current year to March of the succeeding year.

Other Card Features

Supplementary Cards

Share your spending privileges with your loved ones by giving them EastWest supplementary cards. You can request up to nine (9) supplementary cards. You may also assign a monthly sub-limit for each supplementary card to better manage your finances.

Read moreGlobal Acceptance

Use your EastWest credit card anywhere in the Philippines and across the world wherever JCB is accepted.

Cash Advance Facility

Get cash whenever you need it. Simply withdraw from an EastWest ATM, or from any ATM bearing the BancNet or JCB logo using your Cash Advance Personal Identification Number (CA-PIN).

- Applicant must be a Filipino Citizen or local resident foreigner

- Principal Card applicant must be at least 21 years old

- Minimum gross annual income must be:

- Php180,000 for EastWest Privilege Classic Mastercard and EastWest Visa Privilege Classic

- Php300,000 for EastWest JCB Gold and EastWest Dolce Vita Titanium Mastercard

- Php480,000 for EastWest Gold Mastercard, EastWest Visa Gold and EastWest EveryDay Titanium Mastercard

- Php1,000,000 for EastWest Visa Platinum and EastWest JCB Platinum

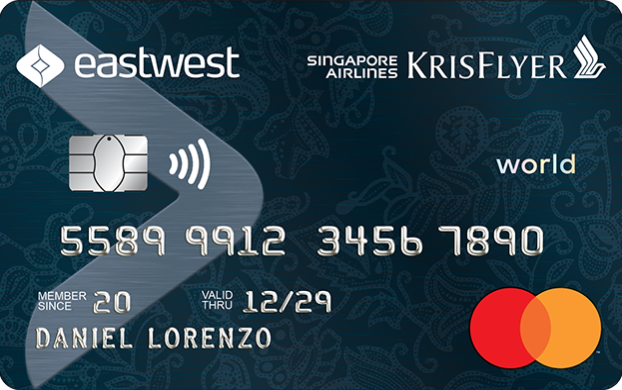

- Php1,200,000 for EastWest Singapore Airlines KrisFlyer Platinum Mastercard

- Php1,800,000 for EastWest Platinum Mastercard

- Php2,600,000 for EastWest Singapore Airlines KrisFlyer World Mastercard

- Must have a residence landline or mobile phone and business landline

- Residence or business address must be within Metro Manila (Caloocan City, Las Piñas City, Makati City, Malabon, Mandaluyong, Manila, Marikina, Muntinlupa, Parañaque, Pasay City, Pasig City, Pateros, Quezon City, San Juan, Taguig, Valenzuela), Cavite (Alfonso, Alvarez (GMA), Amadeo, Bacoor, Carmona, Cavite City, Dasmariñas City, Gen. Mariano, Gen. Trias, Imus, Indang, Kawit, Magallanes, Maragondon, Mendez, Naic, Noveleta, Rosario, Silang, Tagaytay City, Tanza, Ternate, Trece Martires), Laguna (Biñan, Cabuyao, Calamba, Canlubang, Los Baños, San Pablo, San Pedro, Sta. Cruz, Sta. Rosa), Bulacan (Baliuag, Bocaue, Bustos, Malolos, Meycauayan, Obando, Pulilan, San Ildefonso, San Jose Del Monte, Sta. Maria), Rizal (Angono, Antipolo, Binangonan, Cainta, Montalban, San Mateo, Taytay), Batangas (Batangas City, Bauan, Ibaan, Lemery, Lipa City, Nasugbu, Rosario, San Jose, San Juan, San Pascual, Sto. Tomas, Tanauan City), Quezon (Candelaria, Lucban, Lucena, Pagbilao, Sariaya, Tayabas City), Cebu (Bogo City, Borbon, Carcar City, Cebu City, Consolacion, Cordova, Danao City, Lapu-Lapu City, Lilo-an, Mandaue City, Minglanilla, San Fernando, Talisay City, Toledo City), Tarlac (Bamban, Camiling, Capas, Concepcion, Paniqui, Tarlac City), Pangasinan (Binmaley, Calasiao, Dagupan City, Lingayen, Mangaldan, Rosales, San Carlos City, San Fabian, Sta. Barbara, Urdaneta City, Villasis), Benguet (Baguio City, La Trinidad), Pampanga (Angeles City, Apalit, Dau, Floridablanca, Guagua, Mabalacat, Macabebe, Magalang, Mexico, Minalin, Porac, San Fernando City, Sta. Ana, Sta. Rita), Zambales (Iba, Olongapo City, Subic), Davao del Sur (Davao City, Lanang, Mandug, Matina, Mintal, Panacan, Sta. Ana, Talomo, Toril, Digos City), Davao del Norte (Panabo City, Tagum), Misamis Oriental (Cagayan de Oro City, Opol), Iloilo (Iloilo City), Albay (Legaspi City), Camarines Sur (Bombon, Bula, Calabanga, Canaman, Magarao, Milaor, Minalabac, Naga City, Pili, San Fernando), Negros Occidental (Bacolod City, Bago City, Silay City), Ilocos Norte (Bacarra, Batac, Currimao, Dingras, Laoag City, Paoay, Pasuquin, San Nicolas, Sarrat, Vintar), La Union (Agoo, San Fernando City, Bacnotan, Bauang, Naguilan), Zamboanga (Zamboanga City), Nueva Ecija (Cabanatuan, Gapan, Talavera, Palayan, San Jose), Bohol (Tagbilaran City), Isabela (Cauayan City, Ilagan, Isabela City, Santiago City), Bataan (Balanga City), Agusan del Norte (Butuan City), Cagayan (Tuguegarao), Leyte (Tacloban City), Maguindanao (Cotabato City), Lanao del Norte (Iligan City), South Cotabato (General Santos City, Koronadal City), North Cotabato (Kidapawan City), Misamis Occidental (Ozamiz City), Samar (Catbalogan City), Sorsogon (Sorsogon City).

(For Principal and Supplementary Card Applicants)

- Completely filled-out EastWest Credit Card Application Form

- Photocopy of one (1) valid ID with picture and signature (e.g. Company ID, Driver's License, Passport, Professional Regulation Commission (PRC) ID, SSS ID, BIR ID, Postal ID, etc.)

In addition to the above, submit a photocopy of any of the following:

If employed

(For Principal Card Applicant only)

- Latest BIR Form 2316/ITR

- Certificate of Employment stating breakdown of compensation

- Letter of Appointment/Personnel Action Memo

- Salary Adjustment Memo issued within the latest month

- Latest three (3) Months Payslip

- Latest Service Record for government employees

- Valid Credit Card Reference and Latest Month Statement of Account

If self-employed, submit both:

(For Principal Card Applicant only)

- Latest BIR Form 1701/ITR

- Latest Audited Financial Statements (if applicable)

- Valid Credit Card Reference and Latest Month Statement of Account

If local resident foreigner, submit any one (1) of the following:

(For Principal and Supplementary Card Applicants)

- Alien Certificate of Registration with Permanent Status

- Visa issued under Section 9d and 9g of immigration Act of 1940

- Special Investor’s Resident Visa (SIRV)

- Visa issued by Philippine Economic Zone Authority – 47(a)(2)

- Embassy Certification (for Diplomats and Embassy Personnel)

Application processing may take 10 to 15 banking days. Please note that documents submitted in relation to your credit card application shall not be returned.

Frequently Asked Questions

You have several options to activate your EastWest credit card. Here are the ways:

Via Self-Service Facility

- Scan the QR code on the activation sticker or visit www.ewlend.com/actd to access ESTA, our AI chatbot facility. Follow the registration procedure to start using your card.

Via SMS

- Send a message with the keyword “ACT” followed by the last four digits of your credit card number and your date of birth to 22565392 following this format, ACT <space> last 4-digits of card number <space> Birthdate (mmddyyyy)

Ex: ACT 1234 01301990

Via Customer Service

- Call the 24/7 customer service hotline at (632) 8888 1700 or send an email to cards@eastwestbanker.com for assistance.

Depending on your EastWest credit card’s rewards program, you can easily redeem your points for cash rebates through ESTA. Here’s how:

- Go to “APPLY” in the main menu

- Tap on “Redeem Points”

- Follow the on-screen instructions to successfully redeem your earned points

Alternatively, you may call our 24/7 customer service hotline at (632) 8888 1700 or send an email to cards@eastwestbanker.com for further assistance on your rewards redemption request.

With ESTA, you can handle various credit card requests without needing to contact our customer service hotline or wait for a live representative. Here’s what you can do:

- View Real-Time Credit Card Balances: Check your current balance instantly.

- Protect Your Account: Use the real-time locking and unlocking feature to safeguard your card from online fraud.

- View Statements: Access both current and past statements of account.

- Convert Transactions: Turn your purchases into manageable installments.

- Request Credit Limit Increases: Apply for a higher credit limit.

- Report Lost Cards: Quickly report a lost card to prevent unauthorized use.

- Report Declined Transactions: Notify us of any declined transactions.

- Dispute Unauthorized Transactions: File disputes for any unauthorized charges.

- Request Supplementary Cards: Apply for additional cards for your loved ones.

- Enroll in e-SOA: Sign up for electronic Statements of Account (e-SOA).

- View Promos: Stay updated on ongoing and upcoming promotions.

- Send Feedback: Provide feedback directly to our Customer Service representatives.

You can conveniently settle your EastWest credit card bill online through EasyWay, our online banking facility. You may access it via our website or via the mobile app. Log in to your account and choose "Manage Biller" to add the EastWest credit card to your list of billers and settle your bill with ease. Alternatively, you may also pay online through Komo and mobile app of our partner banks and payment centers.

Visit this link for the complete list of our payment channels.

You can enjoy special discounts and privileges year-round from our partner merchants. Whether it’s shopping, dining, health and wellness, or travel and leisure, your EastWest credit card offers you a range of exclusive benefits.

Visit this link for the full list of our promo offers.

Similar account you might like

Credit Cards Promos

The benefits just keep on coming. Find rewards and promos that help you pursue the good things in life.